It started in the traditional manner: unhappy with their current agent, the Lelantus Transport* CFO approached a different broker months earlier. The renewal was now approaching fast, so 5 years of loss runs came to our submission portal along with a message from the Ops Manager:

“Would you like to choose three markets to see whether you can win our business which has half a dozen terminals, and dozens of tractors and reefers?”

I called him back, thanking him in advance for giving us the time needed to build a business case. This would help us choose the most appropriate markets after we had complete and thorough fact-finding conversations with appropriate staff throughout the organization.

I called him back, thanking him in advance for giving us the time needed to build a business case. This would help us choose the most appropriate markets after we had complete and thorough fact-finding conversations with appropriate staff throughout the organization.

Insurance contracts operate on the legal doctrine of utmost good faith. The agent must thoroughly understand the proposed account. Therefore, it’s very important to have extensive and open dialogues with the appropriate staff, taking a keen interest to ask detailed questions to fully understand the responses. After all, to get the best underwriter’s interest in offering the most appropriate and affordable insurance protection, they must fully comprehend what they are evaluating.

Looking at the loss runs, Lelantus had 4 carriers in the last five years, and a deterioration of quality in the insurance companies writing the coverage. This might reveal:

• Insufficient controls or outmoded industry standards of protocols exist within the operations

• Appropriate management tools might not be utilized

• Key personnel could be in the wrong roles

• Proper communication might be inconsistent at the safety/compliance level

• HR techniques and recruitment best-practices may include tactics that need to change

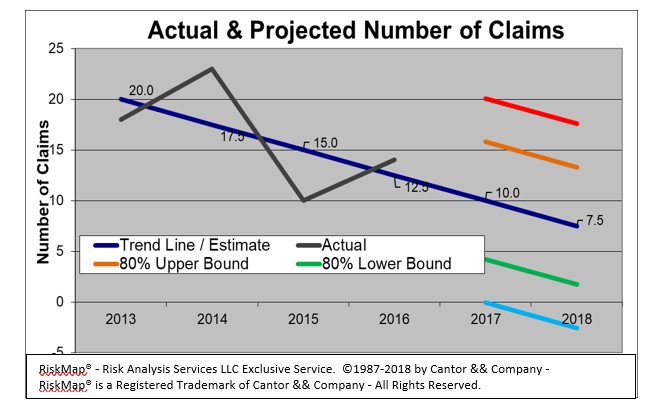

When carriers are changed this frequently, is upper management reacting to increases in premiums, or something else? Insurance carriers ask about losses to help form a judgement on management and its enterprise discipline. For example, at Lelantus Transport, did they notice one driver had multiple claims? And how did they respond? The Ops Manager from Lelantus Transport knew his claims frequency were going down, as shown by this graph from our report here:

He and the CFO were baffled year after year when his broker kept changing carriers and the premiums were still escalating ahead of the industry.

Resumes of executives, managers, and key personnel also paint a picture of company dynamics, and even reveal holes and potential gaps in the organization chart. This could reflect on the safety program or impending acquisitions or divestitures. Each division and each function’s integration into the over-all operation should be part of reinforcing the culture to assure safety.

Resumes of executives, managers, and key personnel also paint a picture of company dynamics, and even reveal holes and potential gaps in the organization chart. This could reflect on the safety program or impending acquisitions or divestitures. Each division and each function’s integration into the over-all operation should be part of reinforcing the culture to assure safety.

Three years of financials add information to our data-sets, especially when there are a lot of claims activity and carrier-hopping. Are there financial pressures on the business which may be forcing to shortcuts in non-obvious ways? Insights on claims and subsequent responses tells a lot about the overall managerial skills and experience. Not to mention that insurers will pull credit reports and their inaccuracy will always negatively affect your indication.

Three years of financials add information to our data-sets, especially when there are a lot of claims activity and carrier-hopping. Are there financial pressures on the business which may be forcing to shortcuts in non-obvious ways? Insights on claims and subsequent responses tells a lot about the overall managerial skills and experience. Not to mention that insurers will pull credit reports and their inaccuracy will always negatively affect your indication.

Lelantus Transport included expiring policies with the loss runs. We took what we got and performed our deep-dive loss forecasting analysis. We do not trend data but perform rigorous analysis based on multiple algorithms. As your company dialogues about your operation, you reveal various areas to test. These hypotheses are part of the loss run analyses we create.

Lelantus Transport included expiring policies with the loss runs. We took what we got and performed our deep-dive loss forecasting analysis. We do not trend data but perform rigorous analysis based on multiple algorithms. As your company dialogues about your operation, you reveal various areas to test. These hypotheses are part of the loss run analyses we create.

RiskMap® our artificial intelligence analytical tool offers a competitive advantage: a unique proprietary algorithms to find correlation and low volatility where it exists but may otherwise be hidden in the loss run information. This is not Excel ‘Goal Seek.’ RiskMap® has been used by self-insured entities and insurance companies for risk analysis. It delivers the ability for us to provide feedback on your operations based on available data, making your process changes more assured and with greater confidence, until we can later say it’s been proven and tested.

RiskMap® our artificial intelligence analytical tool offers a competitive advantage: a unique proprietary algorithms to find correlation and low volatility where it exists but may otherwise be hidden in the loss run information. This is not Excel ‘Goal Seek.’ RiskMap® has been used by self-insured entities and insurance companies for risk analysis. It delivers the ability for us to provide feedback on your operations based on available data, making your process changes more assured and with greater confidence, until we can later say it’s been proven and tested.

Please see the Laidlaw example.

And we use it on your behalf with our insurance carrier partners to find you the best insurance options to get the best possible deal.

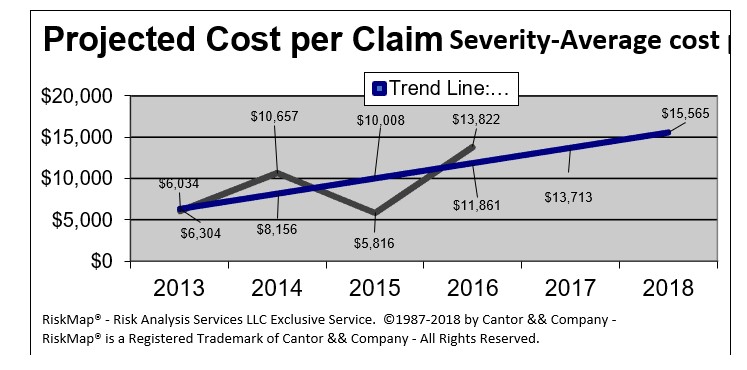

For the insurance companies, our unique risk analysis will give them confidence in writing your business, in a manner which enables them to cover your claims and attain a nominal profit. Lelantus, we found the projected cost per claim was rising, and this may have been why carriers were changing so much.

For the insurance companies, our unique risk analysis will give them confidence in writing your business, in a manner which enables them to cover your claims and attain a nominal profit. Lelantus, we found the projected cost per claim was rising, and this may have been why carriers were changing so much.

When, after multiple rounds of testing, our final analysis showed trended losses of $137,131 up to our proposed SIR, the projected figures for excess claims was only $395,891.

We could now show an insurance underwriter how to structure their coverage and to make this cash-flow manageable for Lelantus Transport.

In other words: how the insurance company can make money on this prospect while providing the best possible deal for the client.

We also shared this auto liability analysis with the incumbent, a non-admitted, off-shore inland marine carrier. They lowered their rates by 12% on the cargo and physical damage. More importantly and significantly, two great American admitted carriers also expressed interest in quoting, despite taking the mutual liberty of declining to quote for the competing brokers.