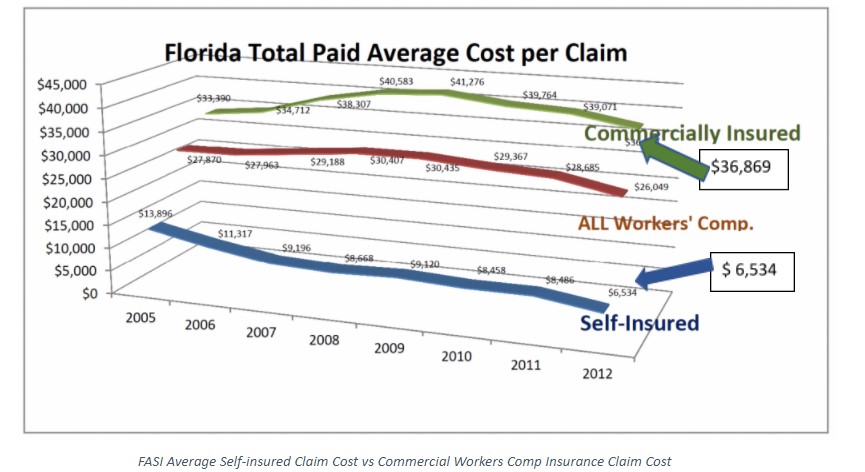

The results on the chart above show year-over-year consistency that self-insureds experienced, indicating they manage to have a great level of control over their operations. The self-insured employers’ average workers comp claim was $6,534 for versus $36,869 for commercially insured employers. And the average cost per claim had declined by over 50% over the timeframe studied, from $13,896 to $6,534. The average commercially insured claim was six times the self-insured average cost per claim.

Continual risk analysis was credited for the success of member corporations at that winter meeting.

FASI members – trucking and transportation companies, contractors, restaurant, car dealers, and retailers- said any size business could try to replicate this continual monitoring. In addition to a risk consultant who offered this analysis, the company needed to incorporate the systems for continuous feedback and control. Many owners, CFOs, directors of HR and risk managers in FASI corroborated the figures on this graph accurately reflected their own organization’s experience.

One CFO always shopped for low prices on insurance before moving over to his self-insured employer. He overlooked active risk management and overspent when commercial insurance premiums should protect against what they could not predict or control. Outside expertise is engaged to develop new data and mine existing data to reveal hidden trends. He directs corporate resources to focus attention on those areas now.