In the transportation field, truck claims can be some of the most catastrophic of any industry and should receive special handling from the beginning. Most risk managers, claim and benefit managers are proactive in managing and settle claims. Complexity and expense rise with legacy claims, those open more than one-year, especially if insurance carriers change frequently.

When more than $25,000 is reserved, we should engage an outside specialist to continually monitor the claim for you. Integrated technology such as that offered by Polestar InsuranceAI™ Services will empower you with the potential to benefit substantially.

In addition to piggy-backing on specialized claim and clinical teams that will dovetail into your ongoing operational risk management using proprietary systems and information for benchmarking.

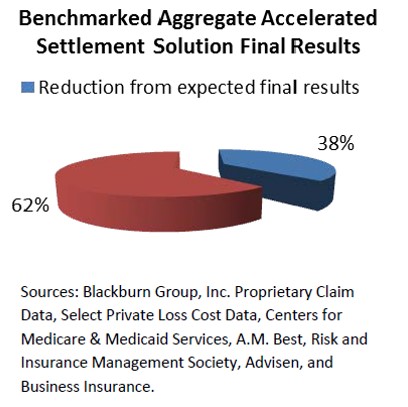

A wealth of technology, data and experienced partners will alleviate headaches and help to manage claims in a methodical and cost-effective manner. With unrelenting focus from these outsourced professionals, the average expected cost of the claim case by 10% to 20% to over 30% in large cases.

A Lloyds of London official offered this endorsement: “It places enormous power in the hands of the Risk Manager and will be warmly welcomed by major Carriers.”